Bookkeeping services in Poland

Szacowany czas czytania 4 min. (609 słów)Bookkeeping services,

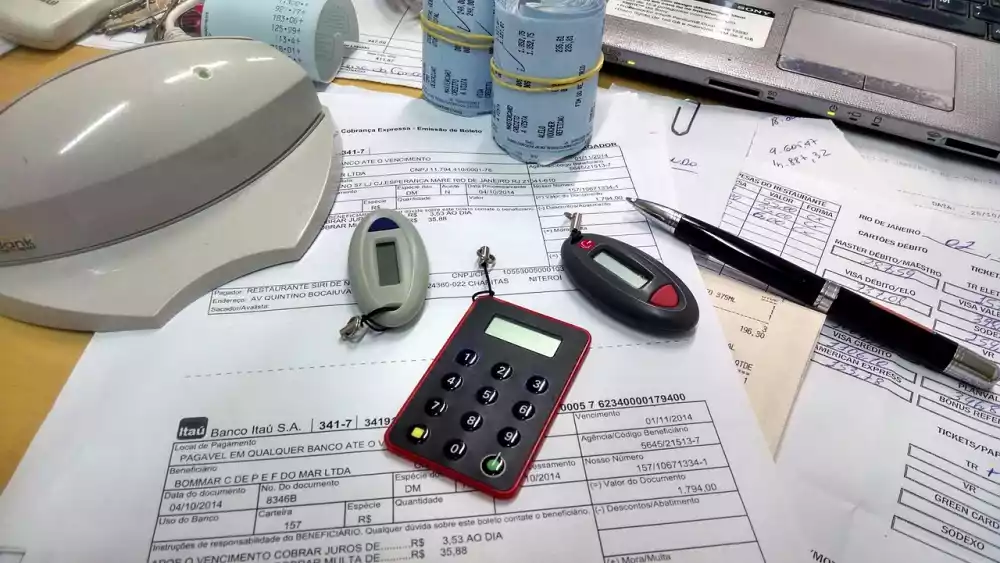

Bookkeeping services are essential for businesses of all sizes, as they handle the meticulous process of recording and managing financial transactions. These services ensure that a company's financial records are accurate, up-to-date, and compliant with various regulatory requirements. By maintaining detailed records of income, expenses, assets, liabilities, and equity, bookkeeping provides a clear picture of an organization's financial health.

One key benefit of professional bookkeeping is improved accuracy. Experienced bookkeepers use specialized software and follow standardized procedures to minimize errors in recording transactions. This precision helps prevent costly mistakes that could lead to financial discrepancies or legal issues.

Another advantage is time savings. Business owners can focus on core activities like sales and customer service while leaving the complex task of managing finances to experts. This delegation not only enhances operational efficiency but also allows business leaders to make informed decisions based on reliable financial data.

Moreover, bookkeeping services provide valuable insights through regular reports such as balance sheets, profit and loss statements, and cash flow analyses. These reports help identify trends, monitor performance against budgets, and plan for future growth.

In addition to day-to-day transaction management, bookkeepers often assist with payroll processing, tax preparation, accounts receivable/payable management, bank reconciliation, and inventory tracking. Their comprehensive support ensures that all aspects of a company's finances are well-organized.

Bookkeeping services for small businesses or startups with limited resources for hiring full-time staff accountants or controllers internally outsourcing bookkeeping can be cost-effective solution They gain access top-tier expertise without bearing overhead costs associated permanent employees

Finally opting professional bookkeeping enhances credibility stakeholders including investors lenders auditors since maintains transparency trustworthiness company’s fiscal practices

In summary professional Bookkeeping Services paramount any organization seeking maintain sound financial footing enabling strategic growth operational excellence, and long-term sustainability. Effective bookkeeping services play a crucial role in managing the financial health of any business, regardless of its size or industry. By meticulously recording and organizing financial transactions, these services provide an accurate picture of a company's financial status.

One significant benefit of professional bookkeeping is ensuring compliance with legal regulations and tax requirements. Accurate records help businesses avoid penalties and fines due to errors or omissions in tax filings. Additionally, organized financial data make it easier to prepare for audits, reducing stress and potential disruptions.

Moreover, reliable bookkeeping allows for better cash flow management. Understanding inflows and outflows enables businesses to budget effectively, forecast future trends, and make informed decisions about investments or cost-cutting measures. This insight can be particularly valuable during economic downturns or periods of rapid growth when financial agility is paramount.

Another advantage is enhancing operational efficiency through streamlined processes. Bookkeepers often utilize advanced software tools that automate routine tasks such as invoicing, payroll processing, and expense tracking. These tools not only save time but also reduce the likelihood of human error, ensuring that financial information remains accurate and up-to-date.

Furthermore, detailed bookkeeping provides valuable insights into business performance metrics such as profitability margins, operational costs, and revenue streams. Business owners can leverage this data to identify strengths and weaknesses within their operations, leading to more strategic decision-making. For instance, recognizing which products or services generate the most profit can guide marketing efforts and resource allocation.

In addition to supporting internal decision-making processes, well-maintained books enhance transparency with external stakeholders like investors or creditors who may require detailed financial reports before committing resources to the business.

Overall, investing in professional bookkeeping services is not just about maintaining order; it's about empowering businesses with the clarity they need to thrive in competitive markets while minimizing risks associated with poor financial management. Whether outsourced or handled by an in-house team equipped with robust accounting systems, effective bookkeeping lays a strong foundation for sustainable success.

Artykuł sponsorowany

O Autorze

AdminOCEŃ TEN ARTYKUŁ: | ||||

|

Komentarz?

Znaczenie nowoczesnych technologii w produkcji reklam - WstępZnaczenie nowoczesnych technologii w reklamieKrótkie wprowadzenie do firmy B52 z GdańskaTechnologie stosowane przez firm...

Znaczenie nowoczesnych technologii w produkcji reklam - WstępZnaczenie nowoczesnych technologii w reklamieKrótkie wprowadzenie do firmy B52 z GdańskaTechnologie stosowane przez firm... Social Media Marketing: Jak Budować Silną Obecność na Platformach Społecznościowych - Social Media Marketing: Jak Budować Silną Obecność na Platformach SpołecznościowychW dzisiejszym dynamicznym świecie ...

Social Media Marketing: Jak Budować Silną Obecność na Platformach Społecznościowych - Social Media Marketing: Jak Budować Silną Obecność na Platformach SpołecznościowychW dzisiejszym dynamicznym świecie ... Personalizacja w Marketingu: Jak Indywidualne Podejście Zwiększa Konwersje - Personalizacja w marketingu to dziś niezwykle ważne narzędzie, które może znacząco zwiększyć szanse na konwersję. ...

Personalizacja w Marketingu: Jak Indywidualne Podejście Zwiększa Konwersje - Personalizacja w marketingu to dziś niezwykle ważne narzędzie, które może znacząco zwiększyć szanse na konwersję. ...